What is EMI?

An Equated Monthly Installment (EMI) is the fixed amount you pay each month to a bank or financial institution until your loan is fully repaid. This payment includes both the interest on the loan and a portion of the principal amount. The total amount owed (principal plus interest) is divided by the loan tenure, which is the number of months over which the loan is to be repaid. Although your monthly EMI remains the same, the interest portion is higher in the early months and gradually decreases over time, while the principal repayment increases. As you continue making payments, a larger portion of your EMI will go towards repaying the principal, and a smaller portion will go towards interest, depending on the interest rate.

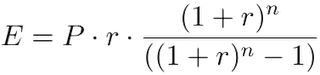

where

E is EMI

P is Principal Loan Amount

r is rate of interest calculated on monthly basis. (i.e., r = Rate of Annual interest/12/100. If rate of interest is 10.5% per annum, then r = 10.5/12/100=0.00875)

n is loan term / tenure / duration in number of months

For example, if you borrow $10,00,000 from the bank at 10.5% annual interest for a period of 10 years (i.e., 120 months), then EMI = $10,00,000 * 0.00875 * (1 + 0.00875)120 / ((1 + 0.00875)120 - 1) = $13,493. i.e., you will have to pay $13,493 for 120 months to repay the entire loan amount. The total amount payable will be $13,493 * 120 = $16,19,220 that includes $6,19,220 as interest toward the loan.